Our Performance

At Giga Certainty, we believe performance should be transparent, repeatable, and grounded in disciplined risk control.

This page offers a clear view of how we deliver consistent results.

Portfolio Returns

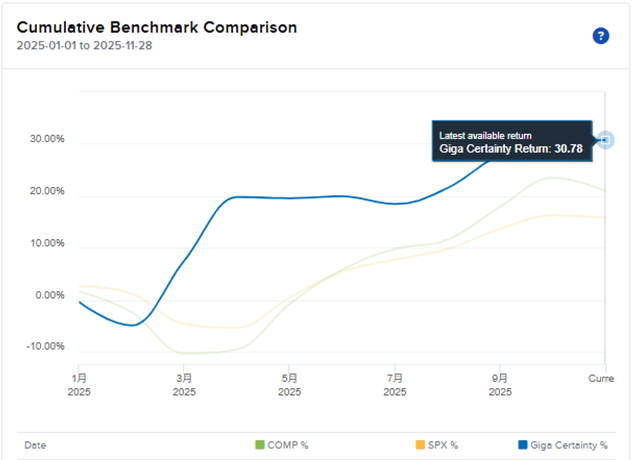

Live performance tracked directly from our Interactive Brokers account, benchmarked against the major US stock index. Updated regularly.

Updated: Nov 30, 2025 | 2025 YTD | Max Drawdown: 4% | Avg Capital Usage: 20%

* Read our latest Portfolio Review here.

Strategy Examples

Fixed examples of our three core position types: Risk-on, Risk-off, and Neutral. Each illustrates how we control exposure and shape reward-to-risk across market conditions.

* Click here to view illustrated examples of our position structures.

Performance Reviews

A running archive of monthly Portfolio Reviews and selected Trade Case Studies, highlighting both portfolio-level strategy and individual execution precision.

* Click the index number below (formatted as date + type) to read the review.

2025/11/30 Portfolio Review

2025/10/31 Portfolio Review 2025/9/26 Portfolio Review 2025/8/15 Portfolio Review

2025/8/13 Trade Case Study 2025/8/11 Trade Case Study 2025/8/1 Trade Case Study

Below are trade reviews from the pre-launch period.

2024/9/5 Trade Case Study 2024/8/28 Trade Case Study 2024/8/5 Trade Case Study

2024/7/24 Trade Case Study 2024/6/29 Trade Case Study

2025/11/30 Portfolio Review

Holding Positive Ground in a Difficult November

Publication Timing

1. Monthly Performance

Over the past month, Giga Certainty delivered a +0.47% return on the overall Portfolio:

Risk-on trades: -0.88% contribution

Risk-off trades: -0.19% contribution

Neutral trades: +1.36% contribution

Fixed-income positions: +0.18% contribution

Relative to history, November 2025 was unusually challenging. The NASDAQ and S&P 500 posted monthly declines of –2.5% and –0.4%, respectively. Equity markets experienced frequent, sharp back-and-forth swings, with multiple days exceeding 1% intraday movement—but few moves persisted longer than two or three days. Long positions struggled, but short positions also failed to generate sustained gains.

Even under these conditions, Giga Certainty still achieved a positive return for the month, driven by our structured and balanced Portfolio approach. Drawdowns stayed contained at roughly 1%, while average capital utilization remained around 10%.

2. YTD Cumulative Performance

Year-to-date, Giga Certainty has achieved a +30.78% total return (monthly compounding). The period’s largest drawdown was about –4% in March, when the portfolio was being set up and adjusted. Average capital utilization has been 20%.

For comparison:

NASDAQ: +20.96% YTD, maximum drawdown –10.26%

S&P 500: +15.83% YTD, maximum drawdown –5.31%

3. Performance Analysis

November saw no major macro catalysts; instead, markets were dominated by shifts in investor sentiment. Conflicting signals from the Federal Reserve—on whether an additional rate cut might occur this year—triggered sharp corrections in technology stocks, cryptocurrencies, and precious metals. However, stronger-than-expected Q3 earnings helped U.S. equities stabilize at key support levels and recover part of their losses toward month-end.

Both Risk-on and Risk-off trades contributed negatively in November. However, our strict control over reward-to-risk ratios ensured that neither category inflicted meaningful damage. In fact, Risk-off trades were close to breakeven.

This month, we enhanced the framework of our Neutral trades, allowing them not only to benefit from sideways or range-bound markets but also to capture directional moves within a defined band. These improvements translated into solid performance and ultimately pushed the overall Portfolio return into positive territory.

Another important feature of this month was our use of idle capital. Roughly 75% of the portfolio was allocated into near-risk-free fixed-income ETFs, and the resulting yield offset most of the losses from Risk-off trades. Maintaining high levels of cash or cash equivalents has always been a core advantage of the Giga Certainty approach, and we will continue to deploy unused capital into highly liquid, virtually risk-free instruments.

4. Positioning and Outlook

In most years, the Santa Rally begins in November. But given the above-average market strength earlier this year, we had expected a meaningful pullback at some point.

In November, the NASDAQ recorded a maximum decline of about 5%, which qualifies as a proper pullback. Our view is that this correction has largely run its course, and the strong earnings momentum among U.S. corporates should help reinitiate the year-end Santa Rally.

For December, our portfolio will adopt a slightly bullish bias, with the newly refined Neutral strategies serving as the core driver. At the same time, if markets become overextended on the upside, we will continue to look for selective short-term shorting opportunities.

5. Risk Management Highlights

Options’ asymmetric payoff structures and high reward-to-risk potential remain essential advantages of our approach. These qualities enable us to maintain an exceptionally high proportion of cash or cash equivalents within the Portfolio.

Balancing long, short, and neutral exposures—while avoiding concentrated bets on any single asset or strategy—continues to be the key driver of Giga Certainty’s long-term performance advantage relative to benchmarks such as the NASDAQ.

Closing Note

November was a difficult month for active traders and index investors alike, but our disciplined structure allowed us to stay positive while keeping risks tightly contained. As we head into the final month of the year, we remain focused on maintaining flexibility, protecting capital, and selectively positioning for opportunities on both sides of the market.

2025/10/31 Portfolio Review

Adapting to Whipsaw Markets with Controlled Exposure

Publication Timing

1. Monthly Performance

Over the past month, Giga Certainty delivered a +1.37% return on the overall Portfolio:

Risk-on trades: +2.20% contribution

Risk-off trades: -0.95% contribution

Neutral trades: +0.12% contribution

During this period, our Portfolio experienced virtually no drawdowns, while the NASDAQ suffered a sharp –4.37% pullback on October 10.

Following the strategy set in the prior month, we incorporated more trading signals in October while deliberately reducing the risk exposure of each position and pursuing higher reward-to-risk ratios.

As the market swung sharply in both directions, we increased trading frequency while lowering average capital utilization to around 10%.

2. YTD Cumulative Performance

Year-to-date, Giga Certainty has achieved a +30.10% total return (monthly compounding). The period’s largest drawdown was about –4% in March, when the portfolio was being set up and adjusted. Average capital utilization has been 25%.

For comparison:

NASDAQ: +23.54% YTD, maximum drawdown –10.26%

S&P 500: +16.30% YTD, maximum drawdown –5.31%

3. Performance Analysis

October was dominated by a series of major macro events — renewed U.S.–China trade negotiations, another FOMC rate cut, and a temporary Middle-East peace accord — all unfolding alongside a dense Q2 earnings season.

These combined factors created strong swings in both directions, with markets eventually breaking higher.

Our Risk-on trades contributed the most this month, led by long positions in semiconductors, silver, and short-volatility structures.

Risk-off trades, by contrast, incurred losses. Although individual stocks and sectors experienced notable pullbacks, macro fundamentals and strong corporate earnings quickly absorbed the shocks, preventing short-side momentum from forming.

Amid these large two-way moves, our Neutral strategies remained roughly flat.

4. Positioning and Outlook

Historically, November through year-end tends to be one of the most bullish seasonal periods in U.S. equities — the so-called Santa Rally.

The October rate cut by the Federal Reserve, combined with upgraded corporate earnings expectations, has triggered the melt-up scenario we anticipated in September. Sentiment indicators and bull-bear ratios now show over optimism.

While our recent Risk-off positions underperformed, we continue to monitor and selectively engage in short-side opportunities. During this traditionally bullish stretch, however, we will rely more on cross-asset hedges and option structures with asymmetric payoffs to manage exposure.

5. Risk Management Highlights

Our Portfolio remains built on mutually balancing positions, leveraging the asymmetric P&L profile of options to maintain an edge.

For the coming month, our focus will remain on shorter trade cycles, tight control of position-level exposure, and pursuing high reward-to-risk setups.

Closing Note

Market momentum and investor sentiment are both extended heading into November.

We remain alert for volatility spikes and potential reversals — but as always, our approach is not to predict, but to position with structure.

Whether the market grinds higher or corrects sharply, Giga Certainty will stay focused on precision, risk discipline, and consistent compounding.

2025/9/26 Portfolio Review

September Gains Powered by Tech, Crypto, and Metals

Publication Timing

1. Monthly Performance

Over the past month, Giga Certainty delivered a +5.33% return on the overall Portfolio:

Risk-on trades: +2.71% contribution

Risk-off trades: +0.12% contribution

Neutral trades: +2.51% contribution

During this period, our Portfolio experienced no significant drawdowns. With more conviction in Risk-on opportunities, average capital utilization rebounded to 20%.

2. YTD Cumulative Performance

Year-to-date, Giga Certainty has achieved a +27.94% total return (monthly compounding). The period’s largest drawdown was about –4% in March, when the portfolio was being set up and adjusted. Average capital utilization has been 25%.

For comparison:

NASDAQ: +17.97% YTD, maximum drawdown –10.26%

S&P 500: +13.72% YTD, maximum drawdown –5.31%

3. Performance Analysis

This month, Risk-on trades were the key driver, as we captured gains from the rising PE of the tech sector following the Federal Reserve’s rate cut.

Meanwhile, our active positioning in cryptocurrencies and precious metals sector benefited from a weaker U.S. dollar.

By contrast, Risk-off trades were flat, offering little contribution this month.

In the face of a strong one-way bull market, Neutral trades played a smaller role but still provided solid returns to the Portfolio.

4. Positioning and Outlook

From October through year-end, we enter the market’s seasonally bullish period.

If the Federal Reserve delivers another rate cut at its next meeting, it could trigger even stronger risk-on sentiment. The combination of seasonal tailwinds and monetary easing could fuel a melt-up scenario — though history suggests such rallies are often followed by a sharp melt-down.

We expect larger directional opportunities (both long and short) to emerge over the next 3–6 months.

5. Risk Management Highlights

Our Portfolio is built on mutually balancing positions, leveraging the asymmetric P&L profiles of options to create an edge.

Looking ahead 3–6 months, we plan to incorporate more trading signals, while deliberately reducing the risk exposure of each position and aggressively pursuing higher reward-to-risk ratios.

Closing Note

September reinforced the value of staying disciplined and diversified across strategies. While tech, crypto, and metals provided strong upside, our portfolio structure ensured that no single bet dominated risk.

As we move into the year’s final quarter, we are prepared for both continued bullish momentum and the volatility that often follows it. Our focus remains unchanged: measured risk, asymmetric structures, and sustainable growth in return on risk.

2025/8/15 Portfolio Review

Balanced Positions Deliver Resilient Results in a Rapidly Rotating Market

Publication Timing

1. Monthly Performance

Over the past month, Giga Certainty delivered a +6.50% return on the overall Portfolio:

Risk-on trades: +0.07% contribution

Risk-off trades: +0.55% contribution

Neutral trades: +5.88% contribution

During this period, the maximum drawdown was –2.45%, and the average capital utilization was 15%.

2. Cumulative Performance Since Launch

YTD, Giga Certainty has achieved a +21.55% total return.

The period’s largest drawdown was about –4% in March, when the portfolio was being set up and adjusted. Average capital utilization has been 25%.

For comparison, over the same period, the NASDAQ returned +11.62%, but suffered a deep maximum drawdown of –15%.

3. Performance Analysis

Speculative trades (Risk-on and Risk-off) contributed less than Neutral strategies during this period. The key reasons:

The most pronounced Risk-on environment occurred between April and June, right after our portfolio was established. The base-effect limited returns during that initial phase.

Since June, although major U.S. indexes have continued to make new highs, there has been significant sector and individual stock rotation, which reduced the effectiveness of directional trading.

4. Positioning and Outlook

Due to geopolitical risks and uncertainty around U.S. economic policy, we have kept average capital utilization relatively low. Moving into the higher-volatility period of the second half of the year—alongside the traditional year-end rally—we plan to gradually increase the position size per trade.

5. Risk Management Highlights

Our maximum drawdown profile remains a core strength of Giga Certainty’s portfolio management. The largest drawdown of –4% occurred in early March and was fully recovered within the month. Maintaining strict control over maximum drawdown remains a top priority going forward.

Closing Note

Our approach remains unchanged: consistent discipline, structural risk control, and measured position sizing. Over time, this is how steady compounding is achieved — not by chasing every move, but by capturing high-quality opportunities with defined risk.

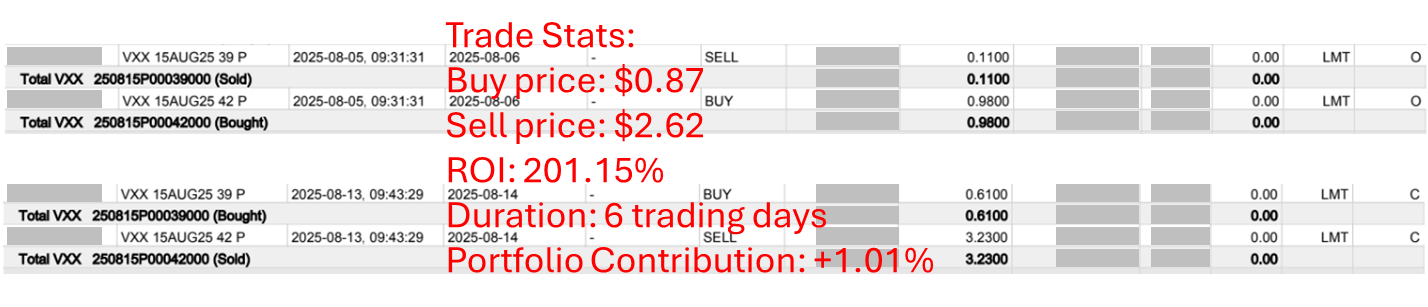

2025/8/13 Trade Case Study

Aggressive Short Volatility Strategy with High Reward-to-Risk Ratio

Click here to read the original trade review.

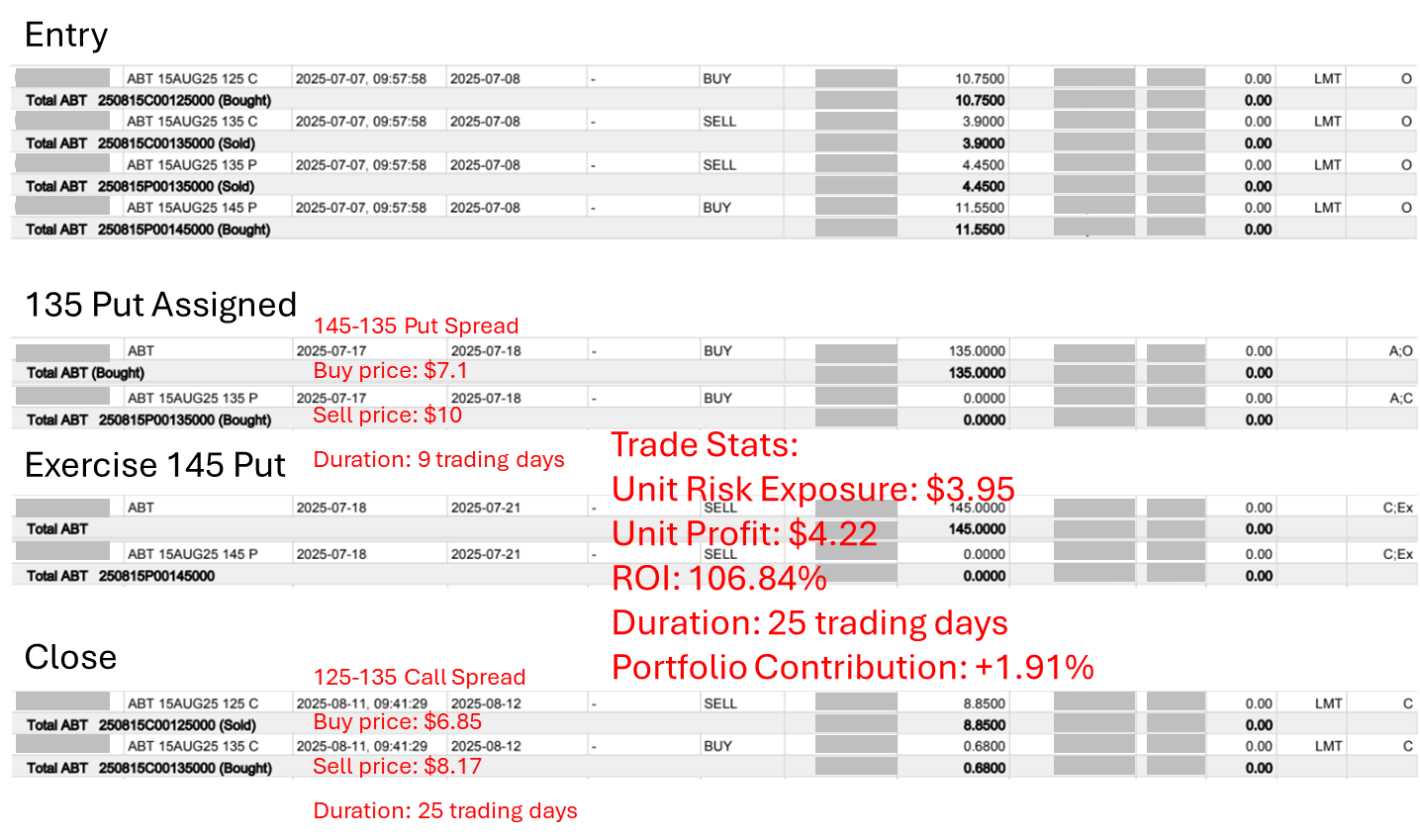

2025/8/11 Trade Case Study

Neutral Strategy to Navigate Wide-Swing Market Condition of Abbott Laboratories

Click here to read the original trade review.

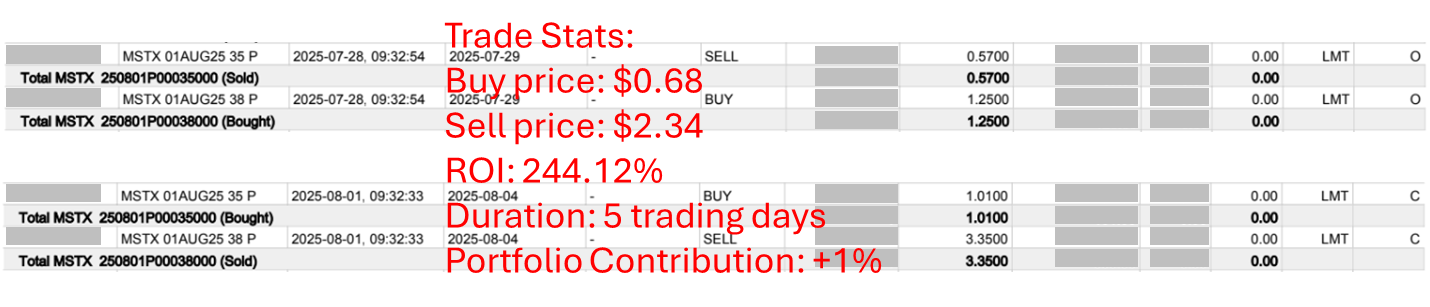

2025/8/1 Trade Case Study

A Safe and Efficient Bet on the Post-Rally Pullback of MicroStrategy (and Bitcoin)

Click here to read the original trade review.

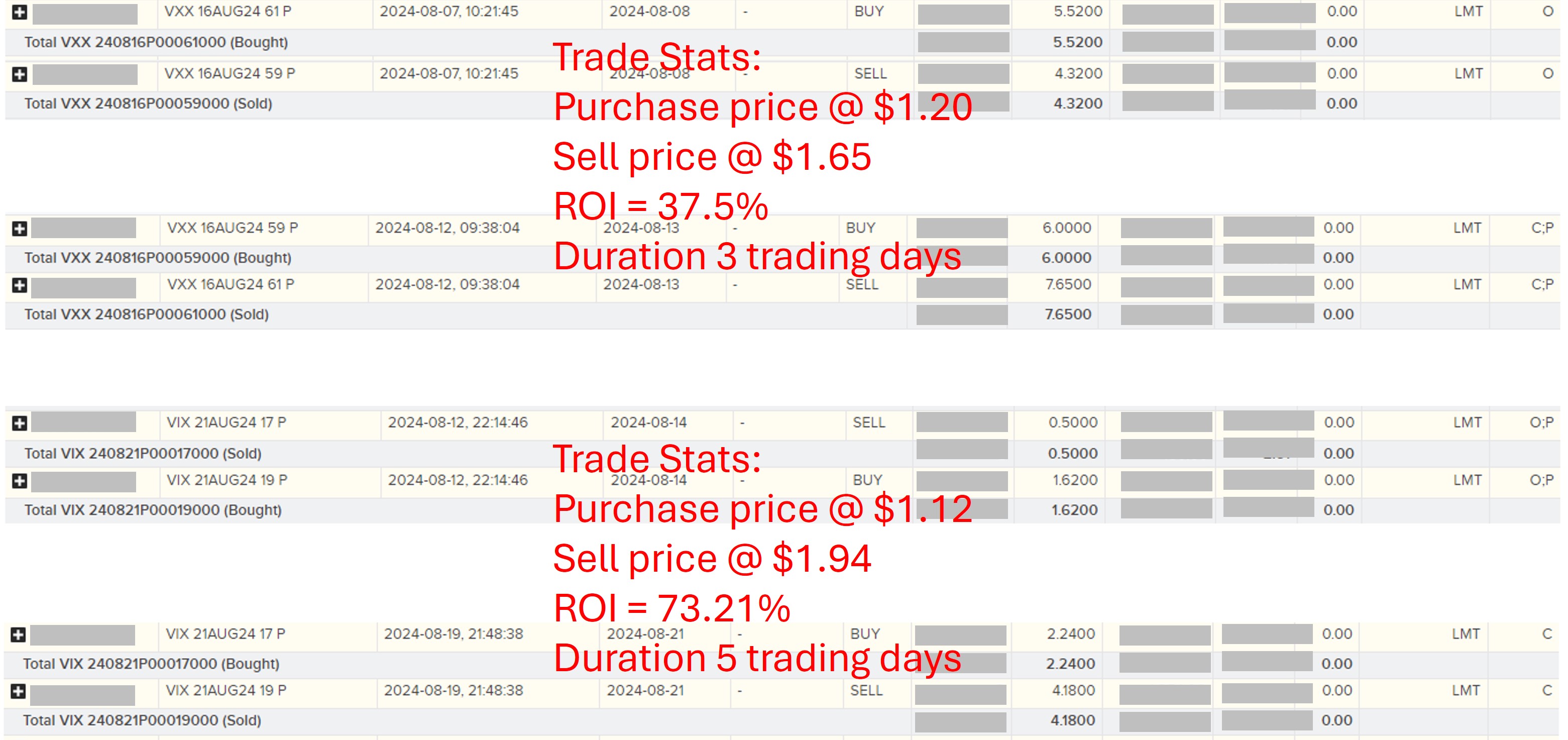

2024/9/5 Trade Case Study

Using VIX Straddle to Bet on Volatility Surge, 69% ROI in One Trading Day

On August 28, we predicted an imminent volatility breakout and placed a two-way bet on the S&P 500 in our trading account (see the original post and subsequent updates here). At the market open on September 3, we further increased our bet by establishing a VIX straddle.

That day, volatility surged as expected, with the VIX closing up 31%. We closed the Call side of the straddle that evening, achieving a 69% return in one trading day, even when calculated based on the total cost of the straddle.

Today and tomorrow, the U.S. will release several key economic reports. We still expect the market to experience significant moves (up or down), so this remains an ideal time to use the straddle strategy to place a two-way bet. We will continue to update on the progress of new trades.

2024/8/28 Trade Case Study

Now Better Bet on Both Directions of the S&P 500 (Using Options)

The volatility surge in early August provided a textbook opportunity to trade the VIX (derivatives). The VIX soared from 15 to a peak of 65.73 in just nine trading days. During this period, we shorted the S&P 500 Put options, easily doubling our profits on two consecutive trades. After the VIX peaked, shorting volatility (using options on VIX derivatives) also yielded decent profits, with two weeks of trading resulting in a total return of over 100%.

The only downside was that after the VIX peaked, the volatility collapse happened too quickly, with the VIX returning to the 15-16 level in just eight trading days. If the VIX decline had been more stable and prolonged, the Put Spread strategy (high VIX is not suitable for buying single-leg Puts) could have captured more profit.

Now that it's been more than a week since the risks have subsided, the market may be approaching another inflection point. Several factors are 'coincidentally' aligning at a delicate timing. The S&P 500 is nearing its all-time high, and the VIX has returned to a level where it needs to choose a direction. From a fundamental perspective, the market has fully priced in the expectation that the Federal Reserve will cut rates in September and by 100 basis points in total this year. Next week, the U.S. will release the latest non-farm payroll data, and the significant downward revision of employment data on August 20 had no impact on the market. Additionally, U.S. equities seem indifferent to geopolitical risks in the Middle East, Russia-Ukraine, and the South China Sea. This means that almost all the positive factors have been priced in, but the risks have not been sufficiently discounted. Moreover, September is a seasonally volatile period for U.S. stocks, and this year, there is also the U.S. presidential election in early November...

Wednesday night's Nvidia earnings report might bring another pleasant surprise, but honestly, we don't have the ability to predict the market. Therefore, an ideal strategy at this time is to use options to go both long and short on the S&P 500 (equivalent to going long on the VIX). The advantage is that implied volatility is currently low, so buying options is not too expensive. We have already established a straddle position, and we will update on the progress of this trade.

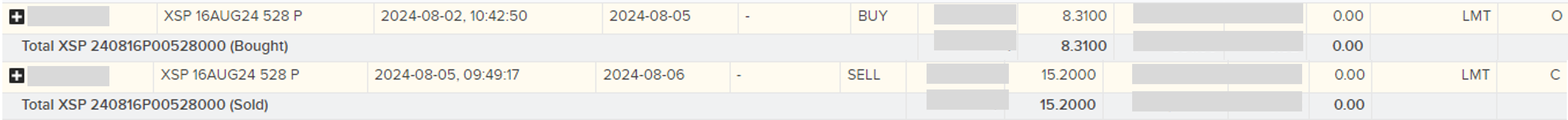

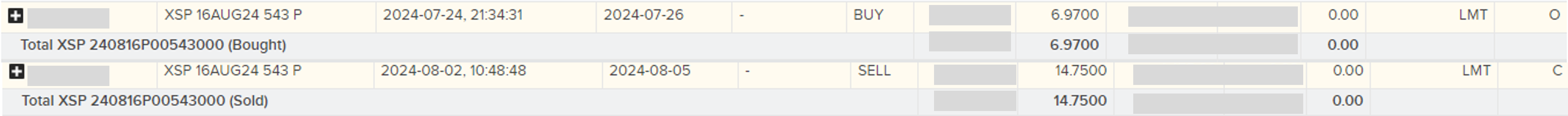

2024/8/5 Trade Case Study

200% ROI in 10 Days by Shorting S&P 500 while Longing Volatility!

On Jul 24, based on our system's signal to SHORT the market, we bought XSP (S&P 500 Mini Index, which can be traded almost throughout the day) Aug 16 '24 543 Put. The implied volatility (IV) of the S&P 500 wasn't that high yet, and the risk-reward ratio for this trade was quite suitable. We made a 111.62% return in one week by shorting the S&P 500. The S&P 500 dropped only 3.5% during this trade, but the implied volatility (i.e., VIX) of the S&P 500 surged from 15 to as high as 29. Additionally, put options have built-in leverage arising from Delta and Gamma explosion. See how powerful volatility trading using options can be. Our volatility indicators were beginning to show some mid-term deteriorating signals for the market. Therefore, we closed this position on Aug 2 and used the profits to continue shorting the S&P 500 at NO COST!

Just one trading day later, on August 5 (the black Monday), the S&P 500 dropped by as much as 5%, and the VIX reached its highest level of fear since the pandemic. Our return on this position approached nearly 82.91%. Given that the implied volatility had become too high, making it unsuitable to open new or hold single-leg put options, we closed this position for a decent profit. We then replaced all our short positions with put spreads expiring in late September. Because of the substantial profits from the 2 trades (200% ROI in 10 days), our short positions are still at ZERO COST!